S Corp vs Partnership

Learn the key differences between S corporations and partnerships and make informed choices for your business

Course Summary

Discover the pros and cons of each business structure, tax implications, and how to choose the right option for your specific needs

Course Curriculum

Highly Recommended Course. Easy to Understand, Informative, Very Well Organized. The Course is Full of Practical and Valuable for Anyone who wants to Enhance their Skills. Really Enjoyed it. Thank you!!

Course Pricing

S Corp vs Partnership

$69 USD

-

Know the different between S Corps and Partnership. Get your clients on the right track.

-

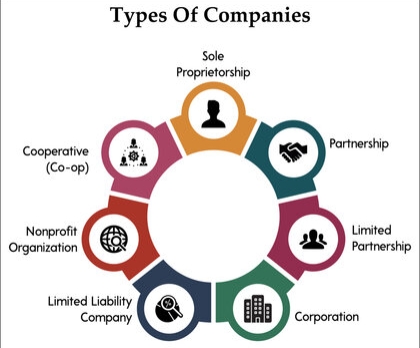

- Introduction to Business Structures

- Pros & Cons Analysis

- Tax Implication

- Choosing the Right Structure

- S Corp vs Partnerships Final